Life Insurance Facts You Need to Know

Is coverage as expensive as people think?

The numbers might surprise you.

Pop quiz

How much do you know about life insurance?

Ask yourself these questions—and then find out the facts:

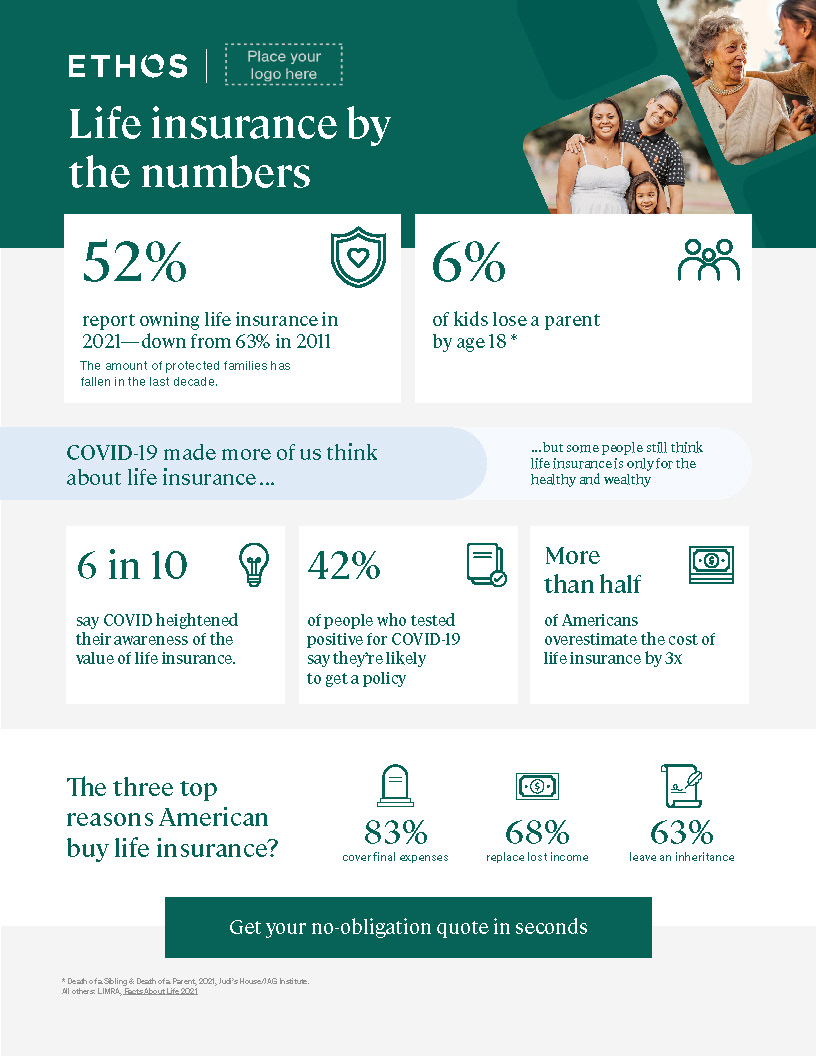

- How many people own life insurance?

- Most Americans overestimate the cost of life insurance. By how much?

- What’s the #1 reason Americans buy life insurance?

- What’s the easiest, fastest way to get coverage without hassle?

The amount of protected families has fallen

Answer: 52% of Americans reported owning life insurance in 2021. That’s a significant decrease since 2011 (63%). The numbers are concerning, considering 6% of kids will lose a parent before age 18, when they need financial protection the most.* Life insurance is an essential safety net for families, providing financial support if the policyholder passes away unexpectedly. If you have a policy, you can rest easy knowing your loved ones are protected, even if something happens to you.

Our partners at Ethos make it easy to get a quote online. If you’re ready to apply, it only takes a few minutes.

People overestimate the cost of life insurance…by a lot

Answer: More than half of Americans overestimate the cost of life insurance by at least 3x! Imagine the price of your favorite fancy cup of coffee, and triple it—sounds wild, right? Too many families are letting this misconception stop them from getting valuable coverage. By using a company like Ethos to find a policy, you can see how certain factors, like term length or coverage amount, affect your monthly price.

The price of life insurance increases as you grow older, so it’s a smart move to take action sooner than later. Once you lock in your price, it’s set for the duration of your term length.

Our reasons for life insurance are deeply personal

Answer: Covering final expenses is the #1 reason 83% of Americans buy life insurance. Additionally, 68% of people got a policy to replace lost income, and 63% wanted to leave an inheritance.† Whatever your reason, Ethos understands getting life insurance is anything but an everyday financial transaction. That’s why they approve 95% of people who apply—because protecting the ones you love most shouldn’t be difficult.

If you’re ready to make a plan for life insurance, start by getting a quick quote now.

Take action to protect your loved ones

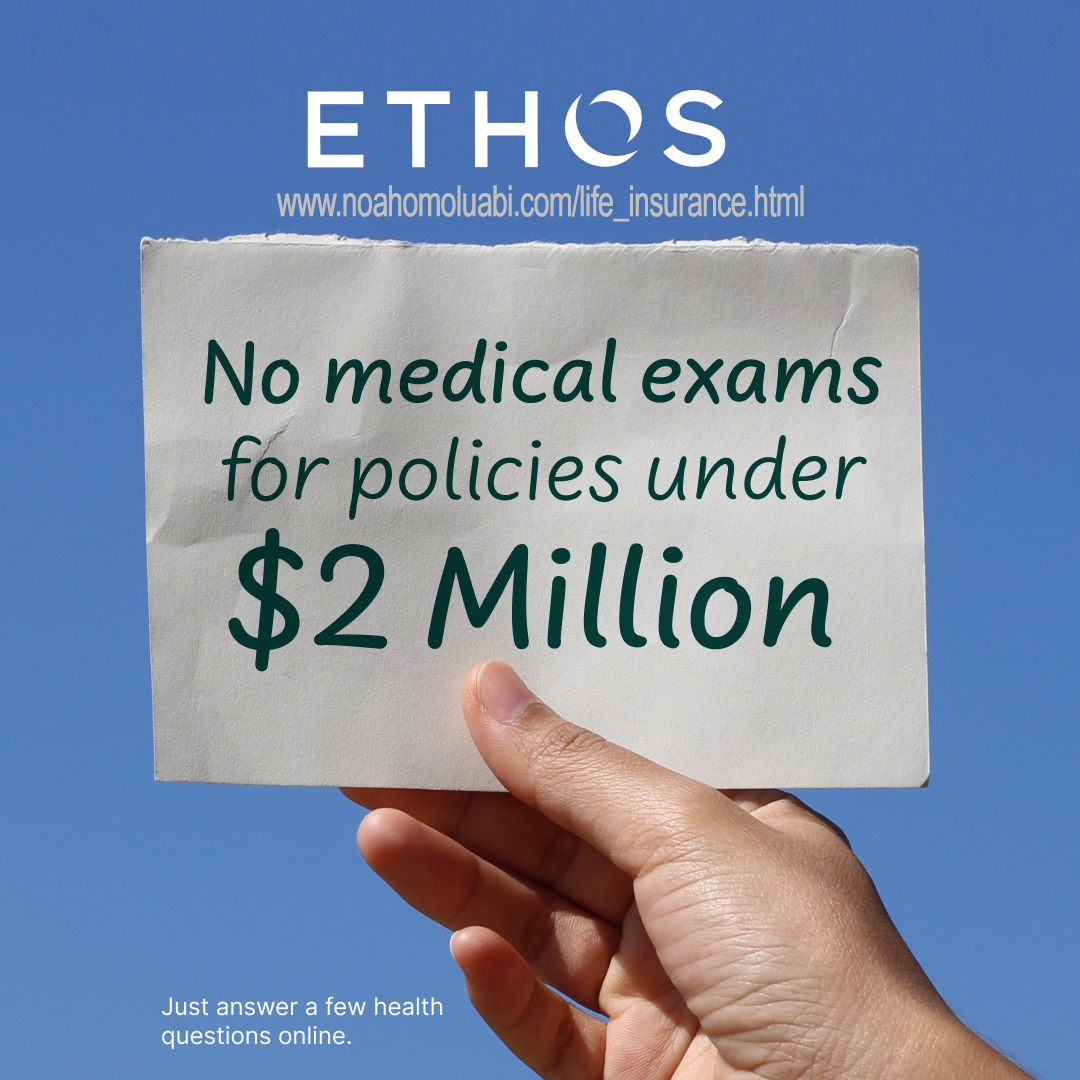

How to get life insurance today without the hassle of medical exams or long waits? The answer is Ethos. In their application, you answer a few health questions instead of going to the doctor or taking blood tests. If you’re ready to make a plan for life insurance, start by getting a quick quote now.

*Death of a Sibling & Death of a Parent, 2021, Judi’s House/JAG Institute.

All other data: LIMRA, Facts About Life 2021 †LIMRA, 2021 Insurance Barometer Study

Money In Retirement Can Be A Challenge

What Money Lessons Are You Teaching Your Children

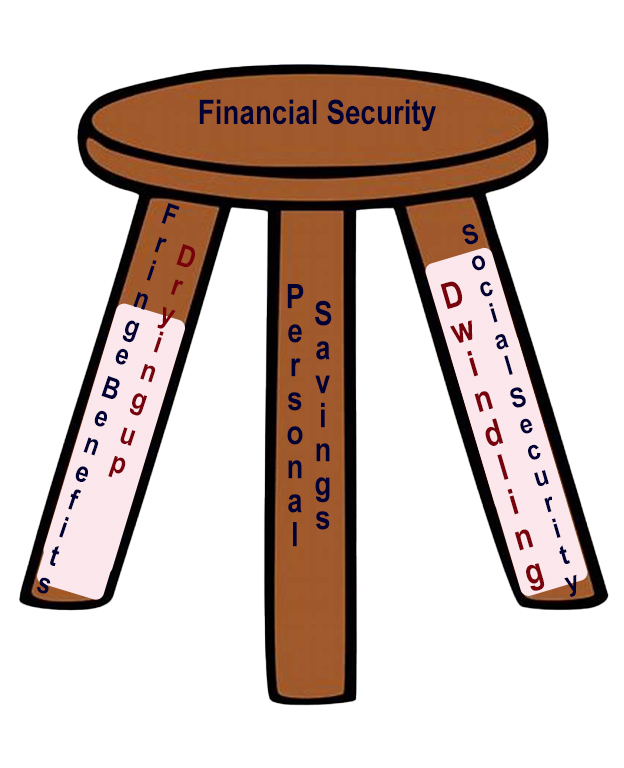

The image of the future is that of a compromised tripod with clear challenges to the retirement legs of social security, company pensions and personal savings. The retirement crisis is compounded by a spending crisis and education loans with no guarantee of appropriate jobs upon graduation. This is real because the financial indices of the future are changing in unpredictable ways.

We all have about 40 years of active physical activity. In other words, by age 65, we begin to look at retirement with seriousness. Limited capital continues to force companies to moderate offers of fringe benefits more heavily. Essentially, no one offers lifelong pensions beyond dwindling thank you ‘gratuities’ these days. And you must have worked for so long to be entitled to those. It is difficult to see people who are willing to work for 35 years out of 40 with the same employer these days. The dynamics of the workplace encourages mobility for career advancement.

With fringe benefits out of the way, and the instability of the social security including the attending inflationary trends that mitigates the value of the check, the only remaining leg remains one’s personal investments. If that is not done wisely, retirement will become a mirage as many are finding out much too late in the day. We can guide you in Adtools Concepts.

Top Five Life Insurance Myths

Don’t let these five misconceptions delay you from protecting your loved ones with life insurance.

More people are preparing for the unexpected

The untimely death of a loved one once seemed like a remote possibility. But the pandemic has brought a new awareness of how vulnerable life can be. Numbers from LIMRA, a life insurance knowledgebase, tell the story:

- Nearly one-third of consumers surveyed (31%) say COVID-19 has made them more likely to purchase life insurance within the next 12 months

You only need to type “funerals” into the search field at GoFundMe to see endless tales of the heartbreaking loss of a loved one, followed by financial crisis for their family. The truth is, life can be breathtakingly uncertain. But the financial impact of a loss can be avoided with life insurance.

We’ve partnered with Ethos to help you find the right policy for your needs, with zero hassle. Get your no-obligation quote in seconds.

The bottom line: Millions of Americans lack critical life insurance. But today, getting coverage is simple with Ethos.

Do these thoughts sound familiar?

Here are five of the most common reasons people put off getting life insurance—and why you should rethink them.

1. I can’t afford it. Research finds people wildly overestimate the cost of term life insurance. Millennials especially overestimate by 5–10x! In fact, a healthy 35-year-old non-smoker can buy a 10-year, $1,000,000 term life policy for about $65 per month through Ethos. That’s less than the cost of many auto and home insurance policies. And of the three—car, house or family—which is more important?

2. My life insurance coverage through work is enough. Workplace coverage is typically 1x salary. That’s not enough to help a grieving family maintain their way of life and fund long-term goals like college tuition. Also, if you leave a job, you can’t always take your life insurance with you.

3. I don’t want to think about it. An Ethos application takes most people less than 10 minutes to finish. There’s no time like the present to spend a few minutes getting the protection your family needs. In the time it takes you to finish your morning coffee, you could be approved for coverage

- The longer you wait, the more expensive life insurance gets. Healthy, younger adults can get the most coverage: up to $2M in term life through Ethos.

- Circumstances can change and future insurability is not a given. Once you get coverage, you’ll never lose it due to health changes.

4. I don’t need it. Some people believe they’ve got sufficient assets to protect their family if the worst happened. In other words, they plan to “self-insure.” It sounds good—but it may be unrealistic. Consider:

- Forty-two percent of Americans would face financial hardship within six months if the primary wage-earner were to die unexpectedly, according to LIMRA.

- A middle-class child born in 2015 will cost nearly $300,000 to raise to adulthood. That’s not counting the cost of college; currently about $80,000 per year for an Ivy League education.

- Did you know that life insurance policies can offer benefits even while you’re living? For example, if you get a policy with a standard terminal illness rider, you could access a portion of the policy’s death benefit if you become terminally ill.

The truth is, you can choose a policy with much more coverage than you can provide on your own, for an affordable rate.

5. The process is too complicated

This used to be the case. When you wanted life insurance, you had to schedule a medical exam, then wait weeks or months for approval from a carrier. But the Ethos process is built for the way people do business in the 21st century, with no need for blood draws or other intrusive tests. Ethos’ technology enables us to approve about 95% of people aged 20–85 in as little as 10 minutes—with just a few health and lifestyle questions.

Take action to protect your loved ones If you’re ready to make a plan for life insurance, start by getting a quick quote from our friends at Now!

When This Time Comes!

What Love Gift Have You For Your Children?

In Adtools Concepts, we like to think of a life insurance policy as a love gift, a token of love to your family perchance the inevitable happens unexpectedly, and one’s death catches everyone off-balance. Naturally, we do not like to think about death, yet it everyone’s reality. When it comes too early, financial hardship tends to complicate the emotional pain of the loss. Life insurance policies help provide funding when such tragedy strikes .

Life insurance can be used to pay off a large debt, such as a mortgage on a home that you want to leave to your heirs. Even if a family member does not earn an income, their death can have impactful financial consequences. For example, the loss of a caregiving parent may cause hiring a replacement to manage caregiving, spend time on household duties, or another family must quit working to replace the person who died.

How Will They Survive?

Essentially, life insurance is a contract between the policyholder and the insurance company wherein the policyholder’s life is covered against some mishap that may result in the untimely death of the policy holder. Therefore, should policyholder die during the term of the policy, the insurance company is expected to pay an agreed amount of money to named survivors.

In short:

- Life insurance can provide a large payout or small regular lifetime payments to survivors when a policy holder dies.

- Proceeds from life insurance are usually tax-free and can help pay off debts, replace income, and cover final expenses.

- Life insurance costs are at lowest when you are young and healthy.

- It is wise to plan a love gift to reduce the emotional loss of your untimely death including the manner of your final committal. We can help!